Chelsea's Financial Fair Play Conundrum

Sales of Key Players is Inevitable

Seemingly every hour brings new updates on the ownership situation at Chelsea FC, from the seizure of the club from the 19 year caretaker and Russian Oligarch Roman Abramovich, to the budget restrictions and frozen bank accounts. The future revenue streams of the club are at risk with the harsh sanctions from the U.K. government, and it is unclear whether a deal will be quickly brokered with one of the many suitors. Questions remain regarding the £1.5 Billion Debt Chelsea FC owes to Foldstam Ltd., the holding company belonging to Roman Abramovich. Answers will most definitely arise in the coming weeks, but until then let’s take a look at the tough financial situation Chelsea FC finds itself in irregardless of the new ownership as it attempts to comply with Financial Fair Play Rules for the 2021/22 season.

Chelsea FC Current FFP Compliance

Financial Fair Play Regulations were introduced by UEFA in the 2011/12 season, with the expressed purpose of “improving the overall financial health of European club football”. To prevent clubs from experiencing large fiscal deficits due to improper financial management from careless owners, the regulations require clubs to spend no more than €5M per assessment period of three years. This threshold is raised to €30M for clubs with owners willing to directly cover the deficit.

On a broad level, the regulations include match day revenues, broadcasting revenues, commercial revenues, and profit from player sales as revenues, and includes operating expenses and cost of player purchases as expenses when assessing a clubs financial health. The assessment does NOT include expenditures on Youth Development, Community Development, Women’s Football, and Stadium Construction. (UEFA)

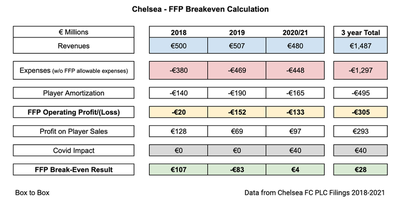

Currently, Chelsea FC sits at a Break-Even Result of €28M over the 3-year accounting period of 2018-2021 (Due to Covid, the fiscal years of 2020 and 2021 were combined). While this may seem quite healthy as it is €58M above the allowable threshold of a €30M loss, the result is propped up by a €128M profit on player sales in 2018 driven by the sale of Eden Hazard.

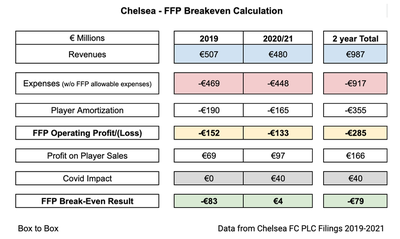

At the end of 2022, Chelsea will have to register their accounting profit/loss from the years 2019-2022. Removing 2018 from this calculation leaves Chelsea with a loss of €79M over the last two accounting years.

In order to comply with FFP in 2022 and reach th3 FFP Break-Even Result Threshold of -€30M, Chelsea must record a FFP financial gain of €49M in the 2022 fiscal year.

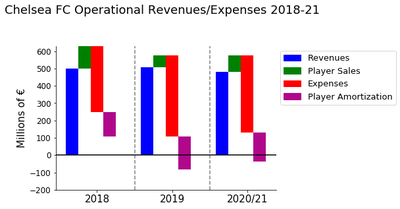

Chelsea’s Revenues, Expenses, and Player Amortization Bill

Chelsea’s Revenues peaked at €507M in 2019 before the pandemic hit, but has been climbing since 2020. The reliability of this revenue stream is up in the air for the time being, especially Match Day revenue as the club is not allowed to sell tickets to non-season ticket holders at the moment (Source). Additionally the shirt sponsor Three UK has temporarily paused its sponsorship deal, another revenue stream in limbo for the club. If a sale of the club is quickly brokered, Chelsea can resume its financial activities and secure its critical revenues.

Chelsea’s Expenses last year rose to €471M, driven by a €57M hike in wages from new signings (Lukaku), contract extensions (Thiago Silva), and bonuses from winning the Champions League.

Chelsea’s Profit from Player Sales has averaged €98M per year, representing a large part of their financial plan to comply with FFP Regulations.

Finally, Chelsea’s Player Amortization, the expense of transfer fees allocated across the length of the transferred player’s contract, was an average of €164 for 2021/22. Amortization is used to flatten the impact of large transfer expenses across multiple years, simplifying balance sheets.

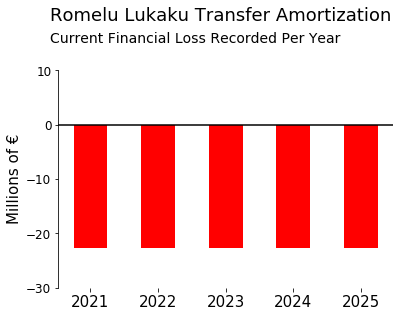

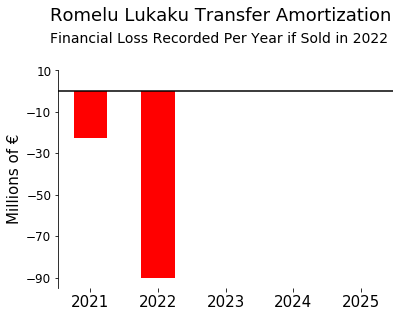

Ex: In 2021 Chelsea FC paid Inter Milan €117M for the exclusive rights to sign Romelu Lukaku to a contract. Instead of expending all €117M to the 2021 accounting books, Lukaku’s transfer fee was amortized across the 5 years of his contract. So Chelsea will record an expense of €22.6M per year for the next 5 years.

Reaching the €49M Break-Even Point in 2022

Chelsea’s daunting task is to reach the €49M Break-Even Point with extremely high expenses, player amortization bill, and uncertain revenue streams. Even if the club was not seized this year, players were going to have to be sold. Selling players will impact the bottom line through increasing profits on player sales and reducing wages. When a player is sold though, the remaining value of the transfer amortization is realized that year, reducing the impact on the bottom line. To illustrate this point, let’s talk about Lukaku again.

The Value of Lukaku’s Transfer from Inter Milan amortized across the length of his contract looks like this:

Note: In reality the £103M is already paid to Inter, this process strictly exists in the accounting books

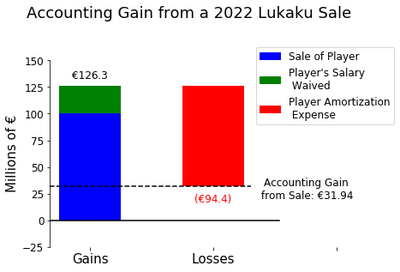

If Lukaku is sold this year in 2022, Chelsea still has to pay the remaining €94.4 left in the Amortization Expense. So the remaining expenses will collapse into 2022 like so:

Let’s say Chelsea manages to sell Lukaku for his current Transfermarkt Market Value of €100M (unlikely given his form this year, but play along). Lukaku’s wages of €26.2M/year will be removed from the books, but the €98.8M Amortization will be realized. In total Chelsea’s bottom line will improve by €31.9M.

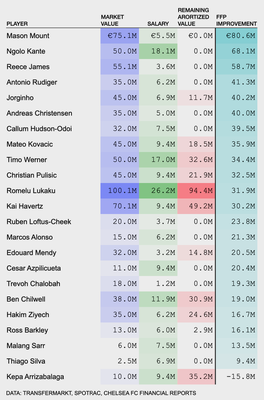

Using the flawed but relatively insightful market values found on Transfermarkt, we can calculate the effect of selling each Chelsea player to their bottom line.

Players from the Academy (Mount and James), and players with low remaining amortization value as they’ve been at the club for years (Kanté and Jorginho), top the list along with players with high market value.

This is where the painful decisions come in. While players like Hakim Ziyech and Marcos Alonso would be easier to part with than the big name players, their impact on the FFP bottom line is relatively minimal. Lukaku and Wener are most likely not going to fetch anything close to the market values listed on Transfermarkt, so their effect would be equally minimal.

The free transfers of Christensen and most likely Azpilicueta and Rudiger will reduce Chelsea’s large wage bill, but players will have to be brought in at a price as replacements.

Assuming Tuchel will refuse to part with his key players, the names Callum Hudson-Odoi and Christian Pulisic jump to the eye as players whose sale can impact the bottom line, but who are not as vital to the team’s success as the other names high on the list. If the club cannot accumulate the funds necessary through their usual sales of youth and loaned players, then expect one or both of CHO and Pulisic to go this summer.

__________

Sources:

UEFA. UEFA Club Licensing and Financial Fair Play Regulations, Edition 18. 1 June. 2018. https://documents.uefa.com/v/u/MFxeqLNKelkYyh5JSafuhg

Financial Data from @SwissRamble, Spotrac, and from the Chelsea Financial Reports 2018-2021 https://find-and-update.company-information.service.gov.uk/company/02536231/filing-history